Hahn company uses a job-order costing system. its plantwide – Hahn Company’s adoption of a job-order costing system, coupled with its plantwide overhead rate, presents a compelling case study for understanding the intricacies of cost accounting. This comprehensive analysis delves into the advantages and disadvantages of this costing method, exploring its impact on decision-making and operational efficiency within Hahn Company.

Job-order costing, as employed by Hahn Company, meticulously tracks costs associated with specific production orders, providing valuable insights into the profitability of individual jobs. This granular approach enables informed decision-making, empowering Hahn Company to optimize resource allocation and enhance overall profitability.

1. Introduction

A job-order costing system is a method of costing that accumulates the costs of production for each job or batch of production. Hahn Company uses a job-order costing system to track the costs of each custom order it receives from its customers.

Under a job-order costing system, the costs of direct materials, direct labor, and overhead are assigned to each job. Direct materials are the materials that are used directly in the production of a job. Direct labor is the labor that is directly involved in the production of a job.

Overhead costs are the indirect costs of production that cannot be directly assigned to a job, such as rent, utilities, and depreciation.

2. Advantages of Using a Job-Order Costing System

There are several advantages to using a job-order costing system. First, it allows Hahn Company to track the costs of each job it produces. This information can be used to set prices, make decisions about which jobs to accept, and evaluate the profitability of each job.

Second, a job-order costing system can help Hahn Company to identify areas where it can reduce costs. By tracking the costs of each job, Hahn Company can identify the activities that are most costly and take steps to reduce those costs.

3. Disadvantages of Using a Job-Order Costing System

There are also some disadvantages to using a job-order costing system. First, it can be more time-consuming and expensive to implement than other costing systems. Second, it can be difficult to accurately assign overhead costs to each job.

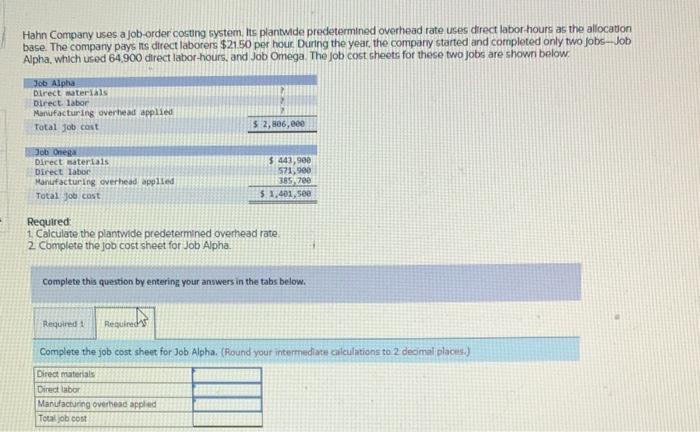

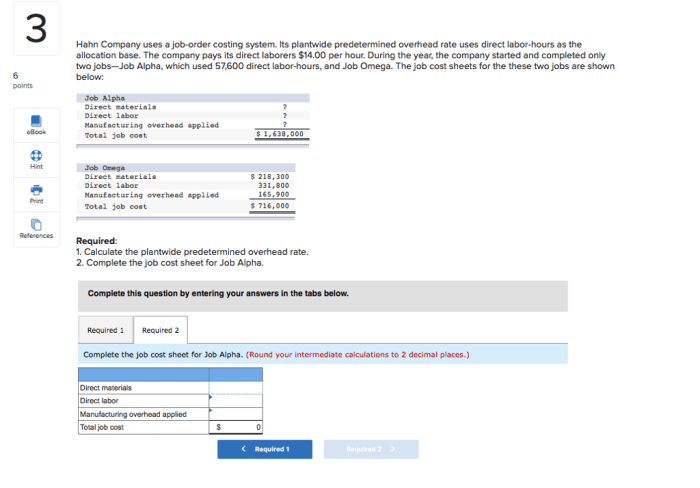

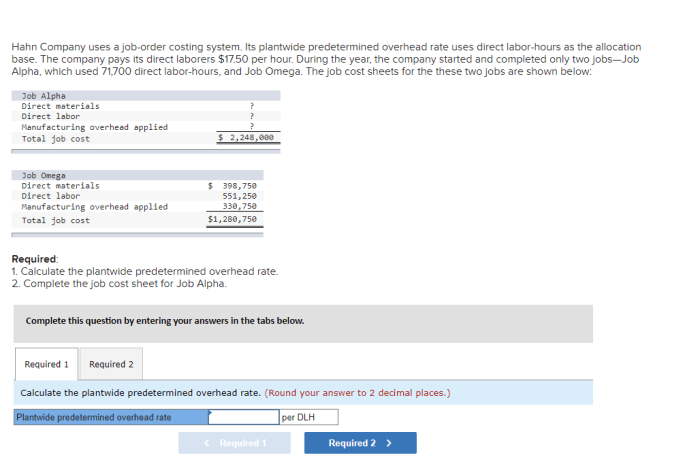

4. Plantwide Overhead Rate

A plantwide overhead rate is a single rate that is used to assign overhead costs to all jobs. The plantwide overhead rate is calculated by dividing the total overhead costs for a period by the total direct labor hours for the period.

Hahn Company uses a plantwide overhead rate of $10 per direct labor hour. This means that for every hour of direct labor that is worked on a job, $10 of overhead costs are assigned to that job.

5. Job Cost Sheet

A job cost sheet is a document that summarizes the costs of a job. The job cost sheet includes the following information:

- Job number

- Customer name

- Date started

- Date completed

- Direct materials

- Direct labor

- Applied overhead

- Total cost

6. Work-in-Process Inventory: Hahn Company Uses A Job-order Costing System. Its Plantwide

Work-in-process inventory is the inventory of goods that are in the process of being produced. Work-in-process inventory is valued at the cost of the materials, labor, and overhead that have been incurred to date.

Hahn Company uses a perpetual inventory system to track its work-in-process inventory. This means that the company maintains a running balance of the work-in-process inventory on hand.

7. Finished Goods Inventory

Finished goods inventory is the inventory of goods that are complete and ready for sale. Finished goods inventory is valued at the cost of the materials, labor, and overhead that have been incurred to date.

Hahn Company uses a perpetual inventory system to track its finished goods inventory. This means that the company maintains a running balance of the finished goods inventory on hand.

8. Cost of Goods Sold

The cost of goods sold is the cost of the goods that are sold to customers. The cost of goods sold is calculated by adding the beginning finished goods inventory to the cost of goods manufactured and then subtracting the ending finished goods inventory.

Hahn Company uses a perpetual inventory system to track its cost of goods sold. This means that the company maintains a running balance of the cost of goods sold.

Quick FAQs

What are the key advantages of Hahn Company’s job-order costing system?

Hahn Company benefits from precise cost tracking for each production order, enabling targeted cost control measures. Additionally, it facilitates accurate product pricing and informed decision-making regarding resource allocation and production planning.

How does the plantwide overhead rate contribute to Hahn Company’s cost accounting?

The plantwide overhead rate simplifies overhead allocation by distributing overhead costs across all production orders based on a predetermined rate. This approach provides a practical and consistent method for assigning overhead expenses.